067. Homesteading Homeschool in the Suburbs

067. Homesteading Homeschool in the Suburbs

Today we’re discovering how urban homesteading as a homeschool family is a lifestyle that can blend hands-on learning with sustainable living. Many homeschool families are cultivating not only gardens but also a deep connection to the land and their community. These practices can bring a simpler and more connected way of life right into suburban neighborhoods and cul-de-sacs, showing how rural traditions can thrive in more urban settings.

Episode 067:

TWO WAYS TO LISTEN TO THIS EPISODE:

1. Click PLAY Button Above ^^ to listen here.

2. OR Listen on your favorite podcast platform:

Brand New to Homeschooling?

GETTING START PAGE >>

Kindergarten Page >>

High School Series >>

Download this week’s FREEBIE

Show Notes

Whether you grew up on a farm or rural homestead or just read about it in books about pioneers, a lot of homeschoolers yearn for a more self-sufficient lifestyle even as we find ourselves in the reality of having to live a more urban lifestyle. But can you have a little of both? Absolutely! Today we’re exploring how suburban homesteaders are redefining self-sufficiency and sustainability. They’re creating backyard gardens, raising chickens, and doing tons of DIY projects. These practices can bring a simpler and more connected way of life right into suburban neighborhoods and cul-de-sacs, showing how rural traditions can thrive in more urban settings.

Urban homesteading as a homeschool family is a lifestyle that can blend hands-on learning with sustainable living. Many homeschool families are cultivating not only gardens, but also a deep connection to the land and their community. From math lessons in the kitchen to science experiments in the backyard, homeschoolers are integrating academic learning with practical skills, fostering a holistic approach to education rooted in real-world experiences.

Epic Homesteading: Your Guide to Self-Sufficiency on a Modern, High-Tech, Backyard Homestead is sure to inspire, motivate and educate anyone who wants to start a homestead, no matter how small or large. What sets this book apart is its step-by-step approach, making the dream of running a productive homestead achievable for anyone.

One of my favorite things about homeschooling is that it allows us to break free from traditional classroom learning and explore opportunities for hands-on learning experiences. And homesteading is one of these opportunities. Creating a suburban homeschool homestead experience opens up endless opportunities for our children to learn and grow. When kids aren’t stuck in a classroom all day, they get to explore the world around them, connect with nature, and learn practical skills that really stick with them. It’s not just about gardening or raising animals—it’s a chance to teach sustainability, nurture creativity, and foster a deep love for our environment. You can also check out Master Naturalist programs by state

Today we’re sharing five ways you can create an educational experience right in your own backyard. These 5 practices will not only boost what your kids are learning academically, but also helps your them build a strong sense of community:

1. Start a Backyard Garden (6:17)

Gardening With Kids

Utilize your outdoor space to grow fruits, vegetables, and herbs. Involve your children in every step of the gardening process, from planning and planting to watering and harvesting. This hands-on experience teaches valuable lessons about biology, ecology, and food production while fostering a sense of responsibility and connection to the natural world.

This is such a fun thing to do with your kids – and you can start when they’re little! Even the pickiest eaters often enjoy eating veggies they grew themselves. And don’t feel like you need to have a grand space to create a garden. You can easily do this in containers and in just whatever available space you have. Some things that are fun and easy to grow are tomatoes and herbs.

Roots, Shoots, Buckets & Boots is the perfect resource to garden with children. It is the perfect resource to garden with children and it includes 12 easy-to-implement ideas for theme gardens that parents and kids can grow together, connecting children to nature through gardening. Each project includes a plan and the planting recipe–as well as a “Discovery Walk,” activities and crafts to make with what you grow.

Community Gardens

Also, community gardens are an option. There are tons of these out there- some are run by churches, some are just part of neighborhood associations or clubs. Look for a gardening club in your area. You can learn a lot from other gardeners in a community garden and share resources- info, seeds, plantings, etc. I’ve also attended several gardening events at the library. Many of these programs are taught by professional horticulturalists in your area for free. Your state college extension office often has amazing resources available for free, too. We used to totally fangirl over Dan Gill, who wrote a series of month by month gardening books that are awesome. These books tell you which plants to plant when and what to do each month of the year for your area.

You Don’t Need a lot of Space

If nothing else, I always have a planter with tomatoes and basil every year. I also really love to grow potatoes with kids- they are the ultimate in easy care and treasure hunting! Kids Garden by Williamson is one of our absolute favorites for gardening inspiration. It’s packed with fun experiments, like growing new plants from existing ones—things like Romaine lettuce from the stalk, potatoes, onions, and even popcorn!

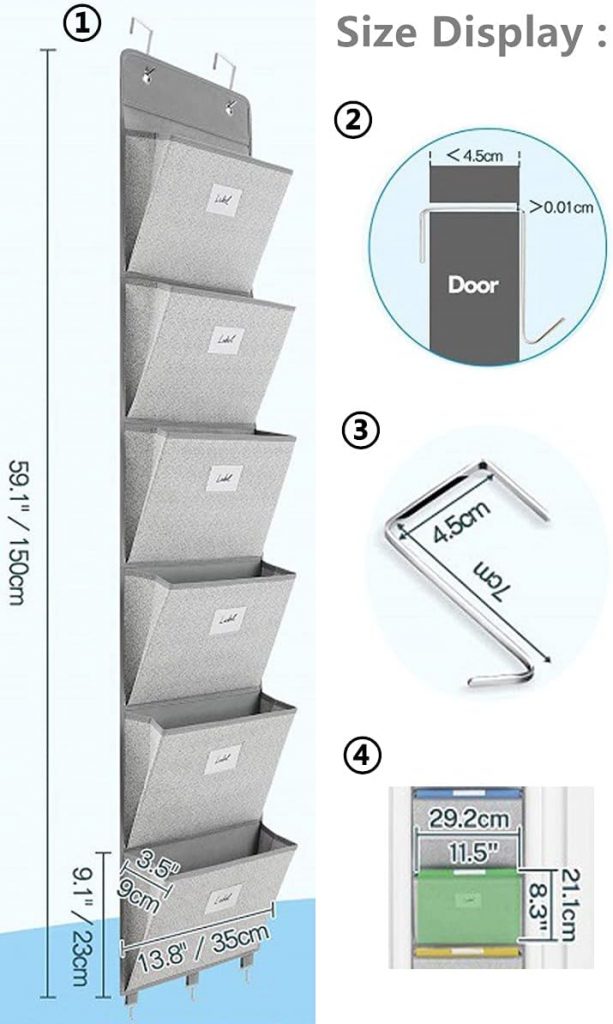

Vertical stackable planters are ideal for limited indoor or outdoor spaces as they save space and enable more plants to be grown in a smaller area. Compared to traditional horizontal planters, they allow for more plants to be grown in the same floor space.

For years, our 2 families, along with several other families, had an adventure kids club that we created. One of the weeks, we built a garden box from scratch- teaching our kids about power tools. Then we got our hands dirty planting and caring for all these exciting plants we’d grown ourselves, along with others. It was such a rewarding experience to see everything thrive and bloom right before our eyes.

Another great source is an oldie but goodie- Square Foot Gardening. It teaches ways to maximize your growing space with advice on what types of plants to grow together, what things you can suspend on trellis or towers, etc.

Composting

Composting or vermiculture (worm composting) are awesome and easy ways to not only learn more about gardening but also to decrease your household waste. This is also a super easy thing to do and does not require a ton of space. I had one of those counter composting buckets tumblers years ago and it was awesome. We tossed everything in there – eggshells, coffee grounds, vegetable peels, and scraps. We also had one of those huge compost tumblers in our yard. When I moved, I didn’t bring it with me because it was so heavy, but the new owners of the house were so excited about it and got some super rich soil!

Composting harnesses the natural process of decomposition by turning organic matter (such as fruit and vegetable wastes, grass clippings, leaves, and some types of animal manure) into a useful product for your landscape or garden. Compost bins are a great way to simplify this process.

2. Raising Urban Livestock (13:52)

You need to check on your local ordinances but more and more cities are allowing for this, making it common practice. You can raise small animals like chickens, rabbits, or bees. Caring for livestock teaches children about animal husbandry, biology, and sustainable food practices. It also provides opportunities for lessons in math (calculating feed ratios), science (studying life cycles), and responsibility (daily care and maintenance).

A Kid’s Guide to Keeping Chickens covers everything from feeding, housing, and collecting eggs to quirky behaviors and humane treatment:

We have a lot of friends who raise chickens. Not only is it great animal husbandry training but if you are producing eggs- there are tons of lessons to be learned in preparing eggs for selling, if you have an overstock and are going that route. I love doing business with little homeschool back alley egg sellers!

Some of our favorite field trips have been to beekeepers. If I had the space, I would raise bees in a heartbeat. I know a lot of people get nervous about bees and if that is you, I highly recommend you make a trip to learn about beekeeping. I did a field trip for our Girl Scout troop last year and told them that- I don’t know that anyone came away from that still afraid of bees.

The Bee: A Kid’s Guide to Getting Started in Beekeeping is a beginner’s guide to beekeeping for younger children. Written by an 8 year old beekeeper; this book gives some basics to beekeeping in easy to understand terms.

The Bartlett Bee Whisperer is a Facebook page dedicated to one guy’s extreme love for Bees. We have enjoyed the Texas Beekeepers Association – they love to educate homeschoolers and have a community education convention every year.

We have another homeschool friend who enjoyed learning about horses so much that they ended up building their own ranch and offering animal science courses to the community. It’s called Tangled Tails Ranch– They’re all about teaching positive animal reinforcement and equine training. If you homeschool in the North Texas area, you should totally check them out- you can find them on Facebook and Instagram. Learning from people who are passionate about the subject they are teaching is always the best way to learn.

FACEBOOK – INSTAGRAM

3. Embrace DIY Projects (17:55)

Engage in DIY projects that promote self-sufficiency and resourcefulness. Build a compost bin, construct raised garden beds, or create a rainwater harvesting system. Download FREE pdf instructions building your own. These projects not only enhance your homesteading efforts but also offer valuable lessons in practical skills, problem-solving, and creativity.

40 Projects for Building Your Backyard Homestead is an excellent resource for homeschool families, offering a hands-on way to teach valuable skills. This guide covers building sheds, feeders, fences, and other backyard structures, with detailed instructions on garden structures, chicken housing, shed construction, solar and wind power, aquaponics, hydroponics, beehives, and basic plumbing and wiring. Designed with simplicity, convenience, and budget in mind, the book provides step-by-step instructions, tools and materials lists, and exploded views, making it accessible even for those with moderate handyman skills. Enhance your sustainable living while teaching your children practical skills and the joy of DIY projects!

I do love my DIY projects! Often, I do them out of necessity because, as a single homeschool mom, there’s not a lot of extra cash for projects, so you learn to figure things out. We do tons of projects and also a lot of home improvements, like the time my awesome dad and brothers helped build my 30-foot deck. My kids and I have done so many projects over the years, it’s hard to even list them all here. Just last year, I did a bunch of upgrades on our home, including siding repair. Of course, I didn’t call a specialist—we bought some cedar and replaced the old rotting boards ourselves. During that minor renovation, we also did a bunch of electrical work. We made a 6-foot tall trebuchet, my son made a guitar, my daughter built a desk, and we rebuilt a ton of cars. And then, if anything breaks, we figure it out and fix it.

We also recommend learning about our environment. Climate change is real and there are so many things we can learn about and do to reduce our carbon footprint. Learning about things like conservation and reduce/reuse/recycling are great lessons that can become great life long habits.

I Can Save The Earth is a fantastic resource for your youngest learners, perfect for ages 2-6. Part of the Little Green Books series, it teaches children on eco-friendly practices through engaging storylines about improving the environment, learning about endangered animals, recycling, and more. It features Max the Little Monster, an initially wasteful and excessive character who learns to appreciate and care for the environment after a power outage forces him to explore the world outside. Your child will follow Max’s journey to environmental awareness and discover practical tips on becoming little green monsters themselves, fostering a love for the planet from an early age.

We got really into recycling and composting when my kids were young and now they are the biggest recycling pros out there. Composting is awesome, too- you can really reduce your household waste and you don’t need a huge amount of space or a fancy container for this.

Compost Stew: An A to Z Recipe for the Earth is a wonderful and easy-to-understand guide for teaching kids how to compost and protect the planet. Perfect for Earth Day or any day, this fun picture book takes readers through the best ingredients for a compost pile, from apple cores to zinnia heads. With composting becoming more common at home and in school gardens, kids will learn how to start a compost pile and what’s safe to include. This book offers simple, child-friendly tips, making it a great way for families to get involved in helping the environment and developing eco-friendly habits together.

Visiting a recycling center or garbage dump is a great field trip. We learned so much at one we visited just north of Dallas. You can also visit places like wastewater treatment facilities or wetlands– we did a field trip and workshop at a wetland area and learned so much about pond/march filtration systems that we worked it into every Future City project after that!

Looking for more conservation field trip ideas for your homeschool? Download our free field trip guide and packet! Packed with tons of fantastic field trip ideas, this resource is available in the show notes. Don’t miss out on enriching your homeschooling experience with these great opportunities.

4. Explore Nature (20:44)

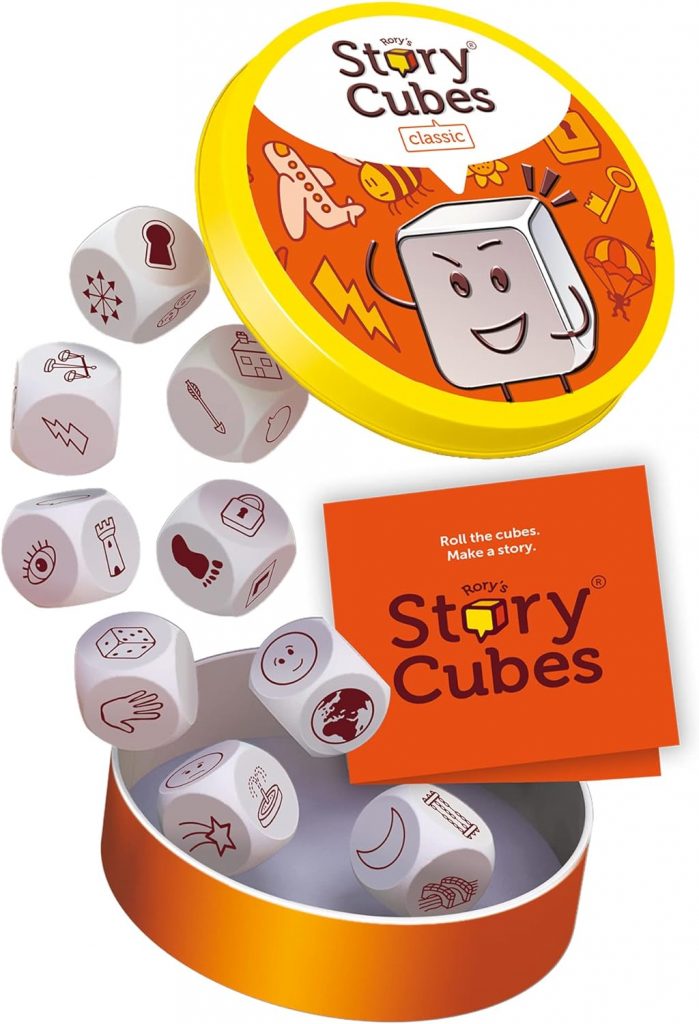

Take advantage of nearby parks, nature reserves, and hiking trails to explore the natural world. Go on nature walks, identify local flora and fauna, and observe seasonal changes. I’ve long had a nature and hiking group and it’s really easy to pull together if you don’t want to go at it alone.

We also suggest incorporating nature-based activities into your homeschool curriculum. You can engage in activities like journaling, sketching, or conducting science experiments outdoors. On this podcast, we always talk about fostering a lifelong love of learning, and doing activities like these helps connect your kids with nature. This connection can ignite their sense of wonder and curiosity while also teaching them about environmental stewardship. To learn more about the benefits of outdoor nature time and getting your family outdoors, check out Episode 022. Homeschooling In The Wild

Help your kids discover the wonders of nature with Peterson First Guides! These beginner-friendly books focus on animals, plants, and other natural wonders. With colorful illustrations and simple descriptions, your kids will have fun identifying birds, animals, trees, and more. The ‘Peterson Identification System’ uses arrows and italics to show exactly what to look for, making it easy and enjoyable to explore the great outdoors together. Spark their curiosity and love for nature with these engaging guides:

Get a bird feeder and keep bird journals about who is visiting your feeder. Visit a store like Wild Birds Unlimited and ask about how to attract different birds to your yard with different foods and seeds. My brother and sister-in law got my mom the Smart Bird Feeder Camera with AI Identify! It is so cool. It can identify over 11,000 bird species, and you can learn all about each one through an app. It’s a fun and exciting way to educate yourself and the kids about wildlife. You also get instant notifications and a live view of the birds visiting your feeder. And the best part? It’s solar-powered so no wiring required.

Visit pick your own farms for berries, or apples/peaches, a dairy farm. Buy your milk or meat from a local purveyor. Visit your local farmers market weekly. We used to have a “honey man” and the kids loved to go talk to their favorite vendors. We got tons of information about planting, harvesting, recipes, etc.

Plant a Butterfly Garden. Learn about the different kinds of host plants that different butterflies require. We also raised butterflies. Years ago, my kids and I were lucky enough to capture this amazing moment of a butterfly chrysalis bouncing and jumping as it undergoes metamorphosis. It’s learning moments like these that make homeschooling so special! Take a Look Below:

We also loved raising fish, frogs from tadpoles and ladybugs, and having an ant farm. One of our friends raised some kinds of fish that they then sold to area people. Some people who have lizards or other reptiles often end up raising the mealworms or crickets that these kinds of pets consume. That can not only be a learning experience but a time and money saver, too.

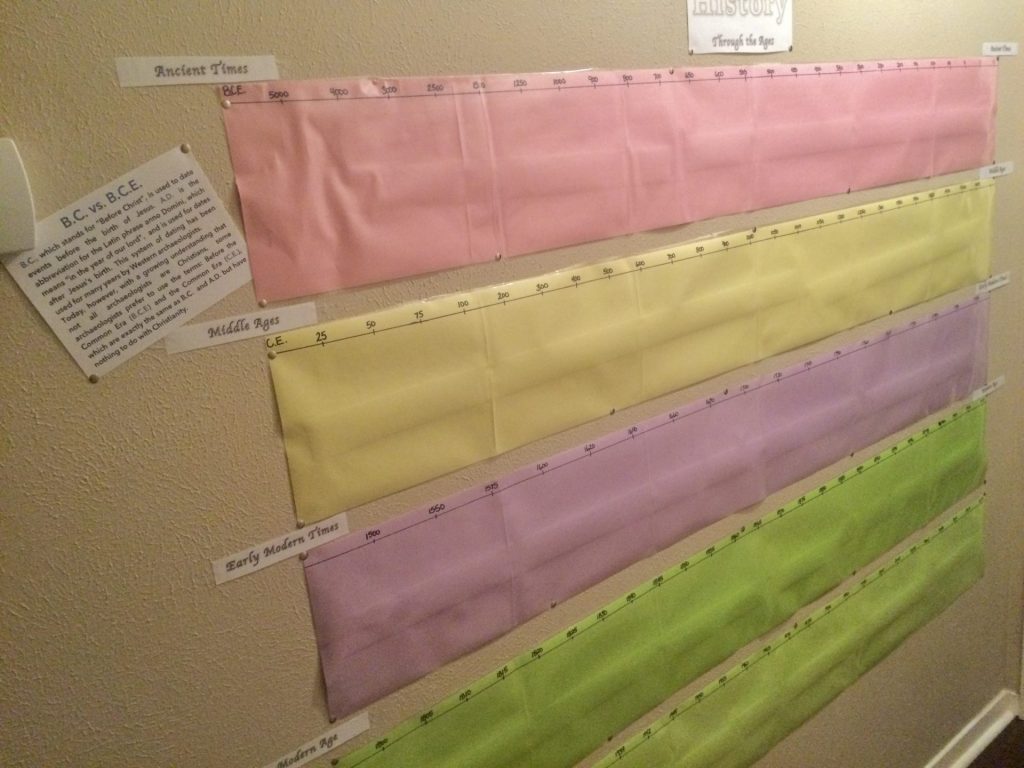

5. Integrate Homesteading into Curriculum (32:30)

Seamlessly integrate homesteading activities into your homeschool curriculum across various subjects. For example, use gardening to teach math concepts like measurement and geometry, or incorporate cooking lessons using homegrown produce to explore chemistry and nutrition.

We have some great episodes about cooking in the kitchen and budgeting and home care. The great thing about homeschooling is that you really can find lessons in everything! Take advantage of everyday tasks, such as meal planning, budgeting, and household chores, as opportunities for practical learning experiences.

Get your FREE Recipe Templates

By exploring some of these ideas we talked about today, you can turn your suburban home into a homeschool homestead that not only sparks a love of learning but also teaches self-reliance and a deep appreciation for the natural world. Urban homesteading can be such a fun and rewarding way to blend education with sustainable living, right in your own backyard. Whether it’s planting a garden, raising a few chickens, or just spending more time outdoors, there are so many ways to make learning come alive.

This Week’s Free Resource

-

Free Gardener’s Notebook$0.00

Free Gardener’s Notebook$0.00